Payment Gateway Integration A Quick Guide

Imagine losing a potential sale at the very last step, simply because your customer couldn’t complete their payment smoothly. Frustrating, right? In today’s digital marketplace, a seamless online payment experience is no longer a luxury – it’s an absolute necessity.

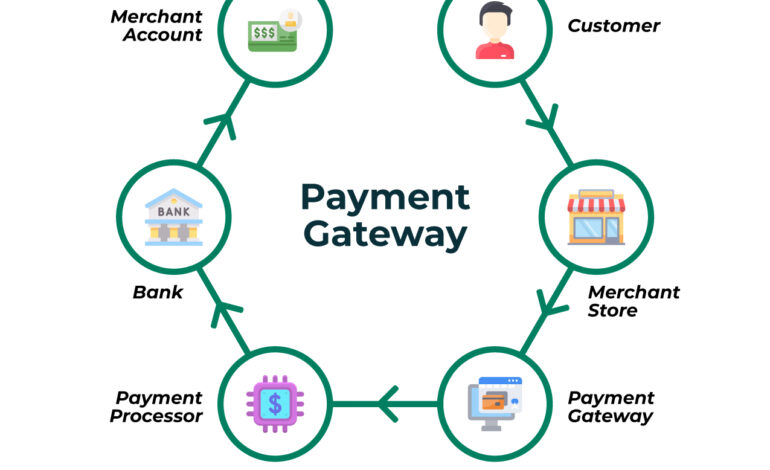

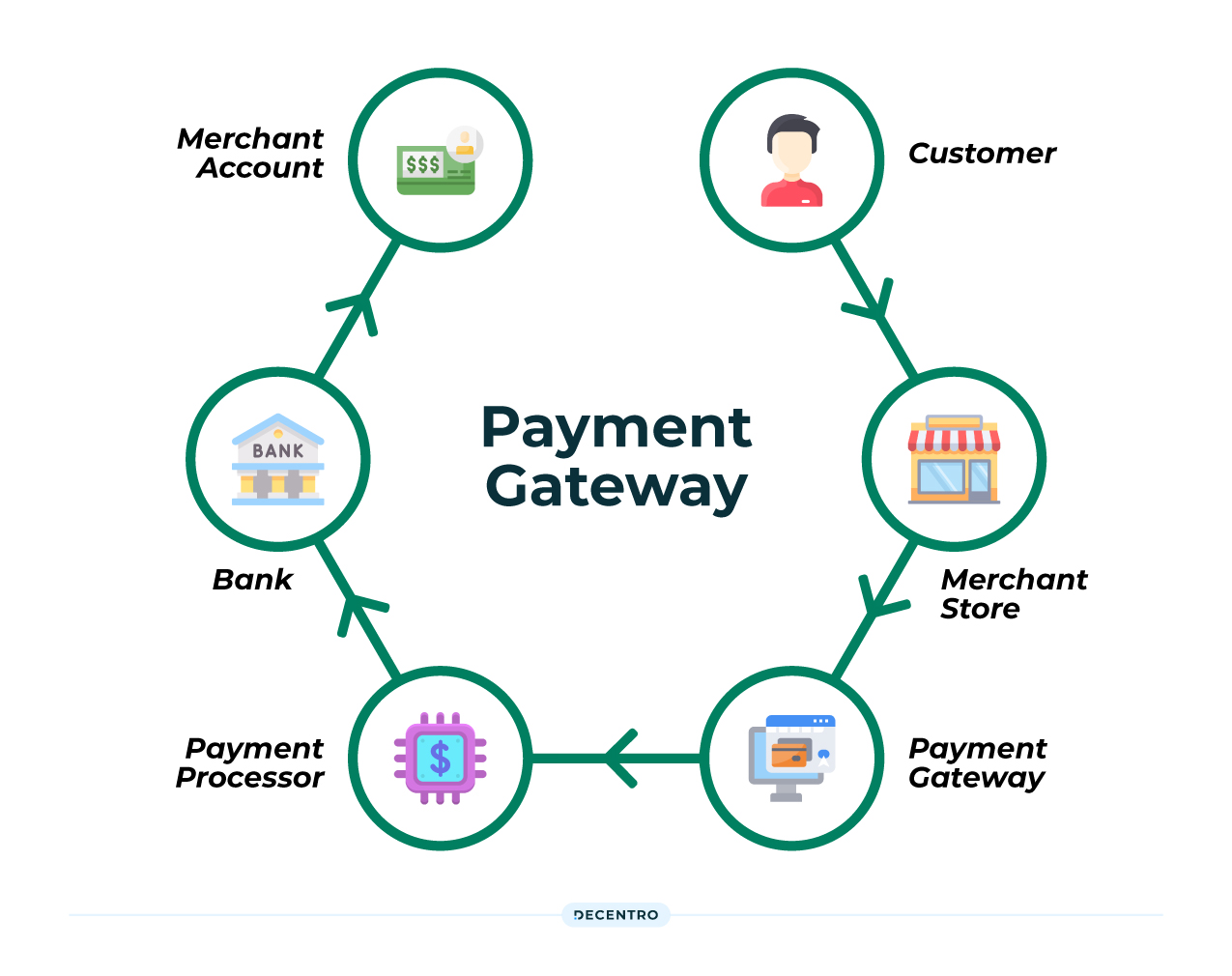

That’s where payment gateway integration comes in. It’s the process of connecting your website or application to a secure third-party service that processes online payments. Think of it as the bridge connecting your online store to your customer’s bank.

Without a reliable and efficient payment gateway, you risk losing customers, damaging your brand reputation, and missing out on vital revenue. This article will delve into the intricacies of payment gateway integration, exploring the key benefits, common challenges, and essential considerations to ensure your online transactions are secure, smooth, and ultimately, successful.

Prepare to unlock the secrets to optimized online payment processing and elevate your business to the next level.

Payment Gateway Integration: A Smooth Path to Online Transactions

So, you’re looking to get paid online? Fantastic! That means you’re serious about your business. But getting those transactions processed seamlessly requires a key ingredient: a payment gateway.

Think of a payment gateway as the digital middleman, securely connecting your website or application to the payment processor and, ultimately, your customer’s bank.

Without a properly integrated gateway, you’re basically handing out your bank account number on a billboard. Not exactly the ideal scenario for secure commerce, is it?

This article is your guide to understanding payment gateway integration, helping you make informed choices and avoid common pitfalls. Let’s dive in!

Understanding Payment Gateways: The Basics

At its core, a payment gateway is a technology that authorizes credit card or direct payments processing for both online and traditional brick and mortar businesses.

It’s the digital equivalent of a point-of-sale terminal in a physical store. It ensures the transaction is legitimate, secure, and the funds are properly transferred.

They act as the vital link, facilitating the flow of funds from the customer to the merchant. Payment information must be encrypted for security and PCI compliance.

This gateway communicates the transaction details to the customer’s bank and then confirms back to the merchant that everything has been confirmed by the bank.

Different types exist, from hosted options where the customer is redirected to the gateway’s site, to integrated solutions where the process happens directly on your website. Your business needs dictate which approach is best!

Choosing the Right Payment Gateway for Your Business

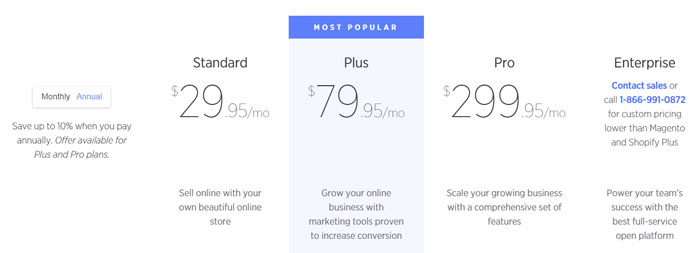

Selecting the correct payment gateway isn’t a one-size-fits-all solution. Several elements must be evaluated to make the best choice for your particular business model.

Consider transaction fees, setup costs, and monthly charges. Read the fine print. Cheaper isn’t always better; consider the features and support offered.

Think about what kinds of payments you wish to accept. Most support credit and debit cards, but what about digital wallets like Apple Pay or PayPal? Consider your customers’ preferences.

Scalability is key. As your business grows, your payment gateway must be able to handle the increased transaction volume. Consider reporting and analytics features.

Security should be paramount. The payment gateway needs to comply with Payment Card Industry Data Security Standard (PCI DSS). It must ensure compliance.

The Integration Process: A Step-by-Step Guide

The actual integration process can vary based on the payment gateway and your specific platform. However, there are some common steps to expect.

First, you’ll need to sign up for an account with your chosen gateway. After signing up, you will be given access to their API for you to implement into your website.

Next, you’ll implement the gateway’s API into your website or application. This involves using their provided code libraries and documentation. It can be complex, so developer support is crucial.

Testing is vital. Thoroughly test the integration with sandbox environments and real (but small) transactions. Validate that payments are processing correctly and that notifications are received.

Go live with your production environment. After rigorously testing, the integration is ready to be deployed for actual payments.

Regular monitoring of payment processing is crucial. Closely watch the payment gateway. Act swiftly if there are any problems to ensure smooth transactions.

Common Challenges and How to Overcome Them

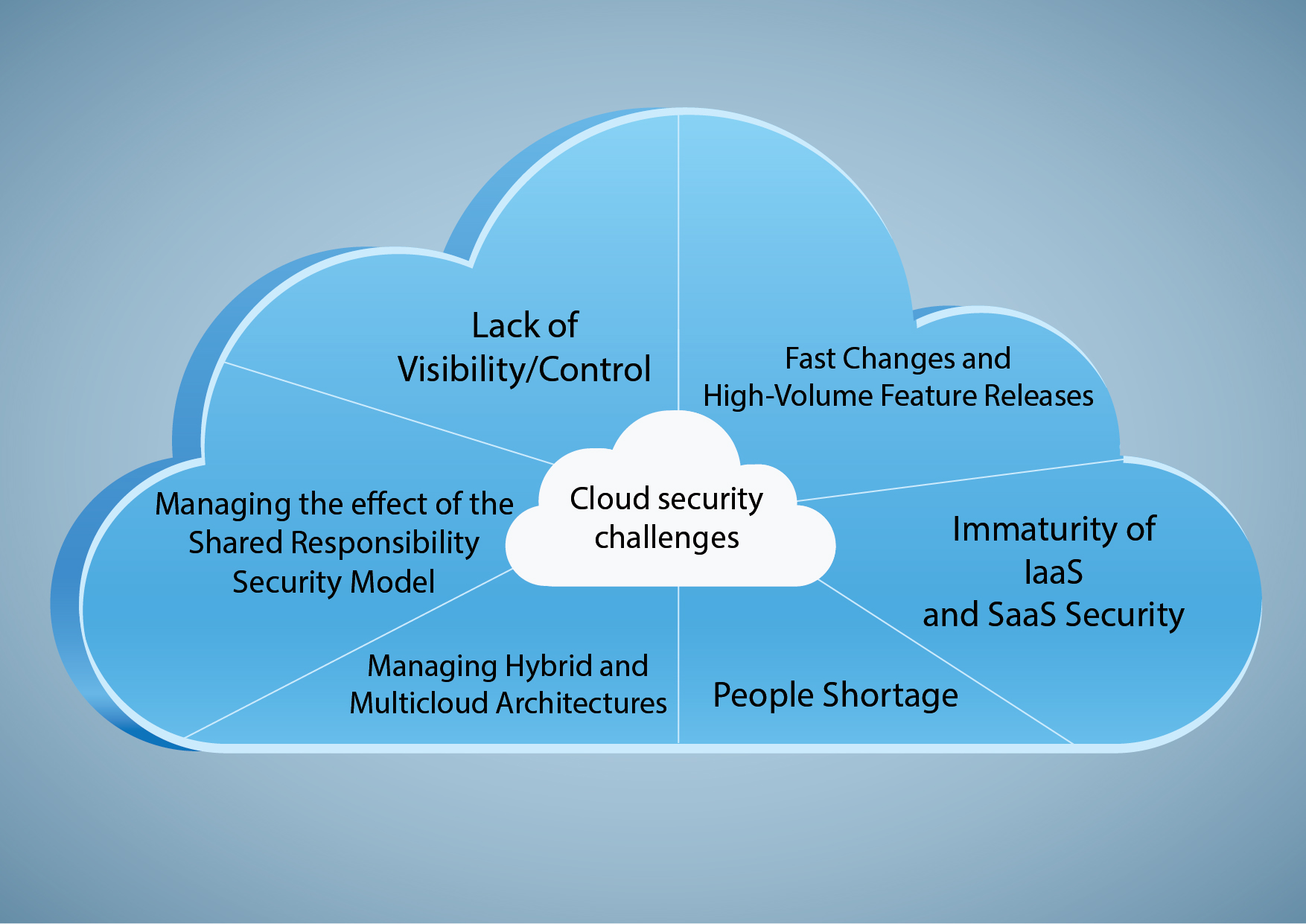

Payment gateway integration isn’t always smooth sailing. There can be various hiccups. Knowing common issues is important to plan how to address them.

One common challenge is compatibility issues between the gateway and your existing systems. Ensure the gateway is compatible with your platform and chosen e-commerce solution before committing.

Security vulnerabilities are a serious concern. Prioritize secure coding practices and keep your systems up-to-date with the latest security patches. Hire cybersecurity professionals.

Dealing with failed transactions and chargebacks can be frustrating. Implement fraud detection measures and clearly communicate your refund policy to customers.

Complexity is a challenge for many. Consider engaging a developer for initial integration. Their expertise will save you time and reduce potential problems.

The Future of Payment Gateway Integration

The payment landscape is constantly changing. Keeping an eye on emerging technologies is key to staying ahead of the curve.

We’re seeing more emphasis on mobile payments, blockchain-based payments, and biometric authentication. Adapting to these trends will be essential for future success.

Seamless and frictionless checkout experiences are becoming the standard. Payment gateways must prioritize ease of use and speed to meet customer expectations.

Expect to see more sophisticated fraud detection and prevention tools being integrated into payment gateways, leveraging machine learning and artificial intelligence.

The push for open banking and standardized APIs will lead to more interoperability between payment systems. This will unlock new opportunities for innovation and efficiency.